This voice is robotically generated. Please tell us you probably have any suggestions.

Snapchat has launched new knowledge exhibiting that Snapchat customers are more and more looking for details about social apps to assist them make monetary companies choices. This might be an enormous alternative for monetary entrepreneurs seeking to promote their newest companies.

This knowledge relies on a brand new examine performed by. Ipsos incorporates responses from 1,100 every day social media customers in america who at the moment personal or are in search of monetary merchandise. The primary goal of this examine was to establish the essential “set off moments” that result in new product adoption, whereas additionally investigating the important thing influences driving such exercise.

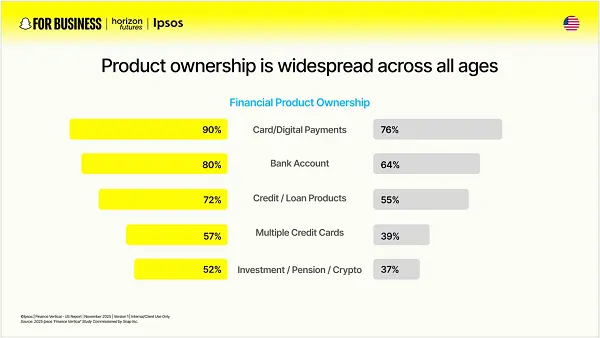

First, the information present that Individuals who use Snapchat usually tend to maintain a number of monetary devices than non-users.

Based on the snap:

“Whereas Millennials lead with a mean of 5 merchandise, Gen Z is quickly closing the hole, proudly owning a mean of three.7 merchandise every. Specifically, those that Snapchat every day are out there for brand spanking new merchandise and are 1.4 instances extra possible to make use of a brand new monetary product within the subsequent six months than non-Snapchatters.””

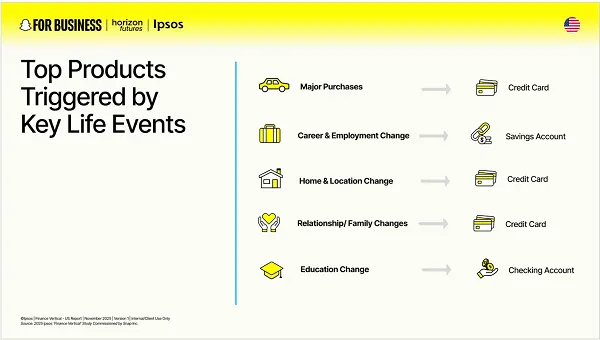

So whereas there is a chance on Snap for monetary entrepreneurs, the information additionally exhibits that Snapchat’s primarily youthful viewers is extra more likely to enter the marketplace for monetary merchandise primarily based on widespread life occasions that set off acquisitions.

“For Gen Z, practically 8 in 10 say they’ve skilled a serious life occasion up to now 12 months, and three in 4 count on at the very least another main life occasion within the subsequent 12 months. They’re additionally extra more likely to embrace monetary instruments and merchandise throughout profession or instructional transitions, whereas Millennials usually tend to search them out when making main purchases, reminiscent of a brand new automotive.”

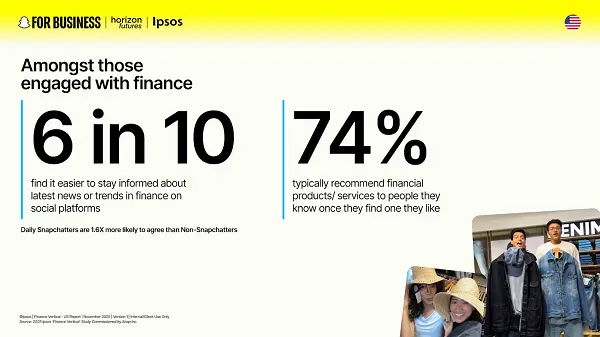

And most of the people now find out about monetary merchandise on-line, primarily by way of social apps.

“Social is the default setting for studying and decision-making, so social is important for manufacturers to interact and drive motion. Eight in 10 individuals who personal or are looking for monetary merchandise say they need to see instructional content material from monetary manufacturers on social media.””

And Snapchat customers are significantly open to this, with knowledge exhibiting that Snapchat customers are twice as more likely to strive new monetary merchandise or manufacturers after seeing them on the social platform.

Additional emphasizing this, Snapchat additionally states: 4 in 10 shoppers need to see interactive product guides on social platforms, and half are already utilizing extra AI or rising applied sciences than they did a 12 months in the past.

“This shift is especially pronounced amongst Snapchatters; 2.1x excessive rate of interest If you wish to find out about monetary merchandise utilizing AR. AR and AI may also help bridge the hole between curiosity and confidence by permitting shoppers to visualise their choices and discover eventualities earlier than committing. ”

There is not any telling how necessary AI and AR shall be to monetary decision-making. And we’re not suggesting that you just place an excessive amount of belief in AI instruments relating to your cash. However at the very least conceptually, Snapchat customers are open to monetary promotions and recommendation inside the app, which might be a invaluable focus for entrepreneurs.

Learn the total Snapchat Way forward for Finance report right here.