○What’s fascinating about budgets is that folks do not often do a actuality verify by evaluating them to earlier budgets as a result of they concentrate on the present price range. For the reason that 2026-27 price range is kind of a useless finish, it might not be misplaced to begin with the final price range.

If there’s one factor to recollect about Finances 2025-26, it is the large announcement of unprecedented tax cuts for the ‘center class’. Regardless of the tax cuts, the federal government assumed that revenue tax revenues would improve on account of elevated compliance and rising center class incomes. However did that occur?

look again

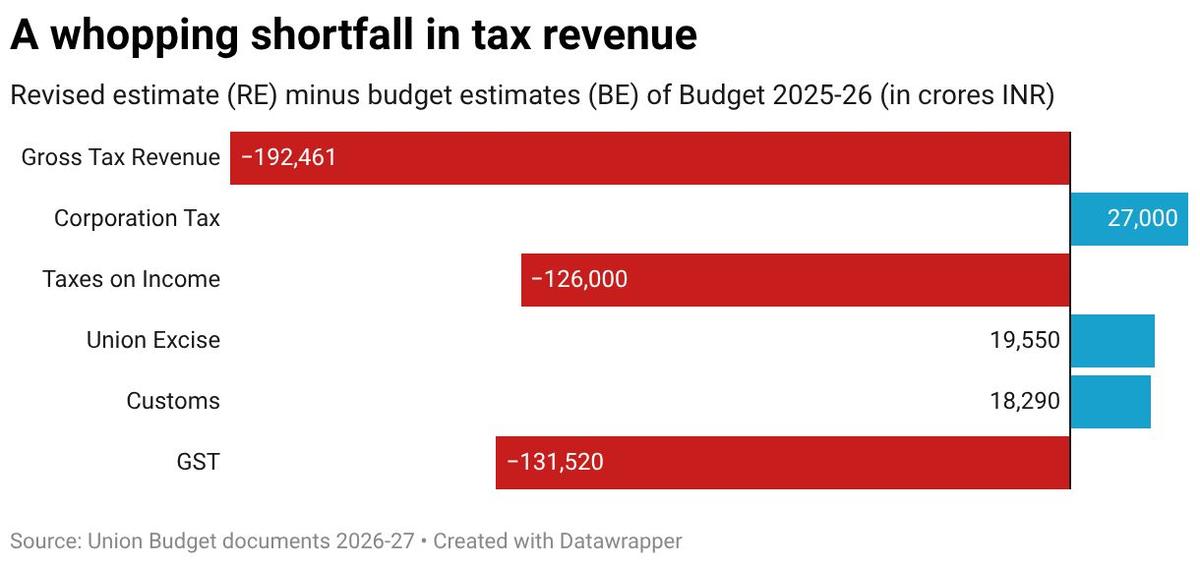

As we argued on this column final yr, tax bets can and don’t repay. Earnings tax income is effectively under the estimated 14.38 billion. In response to the Revised Estimate (RE), the restoration quantity is 13.12 billion, so there’s a shortfall of 1.26 billion. Added to this can be a related shortfall of 1.31 billion GST collections. Nonetheless, if company, union, and excise tax outcomes had been barely higher than anticipated, the whole tax income shortfall would have been a lot larger than the 1.92 billion (tax portion of the graph).

Certainly, this deficiency itself may be dismissed as a mistake in expectations. However the issue turns into much more acute when spending is tied to tax assortment (strictly primarily based on deficit focusing on guidelines). If spending is instantly tied to income assortment, a shortfall of this dimension will inevitably result in vital spending cuts. Not surprisingly, spending has been minimize virtually throughout the board (spending part of graph). A lot-touted capital expenditure (capex) was additionally minimize, as had been agriculture, schooling, well being care, rural improvement, and concrete improvement. Misguided authorities expectations price poor individuals their incomes, employment, schooling, and well being.

Not for 2026

The fiscal yr 2026-27 price range must be evaluated primarily based on this. This yr will likely be a yr of political and financial uncertainty. India is in a precarious place between a present account surplus with the US and a deficit with China. India’s exterior scenario might really deteriorate if exports are affected as imports are unable to counter the drop on account of President Donald Trump’s tariff wars. Financial analysis at the very least acknowledges this risk, though the likelihood is as little as 10%. Within the essentially unsure world we presently discover ourselves in, we do not need to escape to likelihood idea.

The Finances appears to take this risk a little bit too actually. It’s deliberate as if we’re nonetheless in 2025 and such a deterioration of the exterior sector might not happen. If exterior demand really worsens, it is going to be necessary for the federal government to additionally concentrate on home demand, at the very least as a Plan B. In regular instances, there would have been no downside with a standard price range like this one, however that’s not the case this yr. As with the earlier price range, the main focus is on fiscal soundness, capital funding, employment measures on the availability facet, and credit score ensures for MSMEs. Regardless of an identical macroeconomic method in earlier budgets, employment numbers, particularly for younger individuals, weren’t precisely encouraging. Neither is company funding. If present methods aren’t working, should not the federal government return to sq. one? Nonetheless, what we received is about the identical. This lack of creativeness comes from a blinkered imaginative and prescient of how the financial system works. Provide-side measures work solely when complemented by demand, not by themselves.

Let’s look once more on the case of public capital funding as a requirement measure. All capital investments will not be equal. Capital funding in agriculture, well being care, and schooling isn’t the identical as capital funding in highways. The primary is to create jobs as demand expands. Now, in a world the place we do not examine one capital funding to a different, this would not be an issue. Nonetheless, a significant issue exists in an financial system the place capital funding in infrastructure comes on the expense of capital funding within the type of improvement spending, and the place gainful employment is restricted. We preserve boasting that our demographic dividend will peak in 2030, however we’ve got already misplaced most of it on account of excessive youth unemployment. The scenario is even worse for ladies, particularly in city areas.

goal not discovered

What might the Finances have executed as a substitute? First, it ought to have deserted its hawkish fiscal stance, particularly in an unsure yr like this one. Precedence ought to have been given to employment-intensive improvement spending and welfare spending, which even have the flexibility to create multidimensional demand. And second, this was most likely the yr to harshly criticize air pollution bulls. On the streets of Delhi, individuals had been demanding motion. For the primary time, it grew to become a political subject. A battle towards air pollution was wanted, however I do not see any point out of it, not to mention allocation. That is a misplaced alternative.

Rohit Azad teaches economics at JNU. Indranil Chowdhury teaches Economics at PGDAV School, College of Delhi